unemployment tax credit check

New 1100 stimulus checks are. Credit card payments on unemployment tax accounts are not eligible for partial or full refunds until 180 days after the credit card payment date.

Irs Issued 430 000 More Unemployment Tax Refunds What To Know Cnet

The Child Tax Credit is expected to roll out July 15.

. In Box 1 you will see the total amount of unemployment benefits you received. The IRS has just started to send out those extra refunds and will continue to send them during the next several months. How to sign up for 2022 stimulus checks worth up to 8000.

June 1 2021 435 AM. Enter the unemployment compensation amount from Form 1099-G Box 1 on line 7 of Schedule 1 Form. STAR Check Delivery Schedule.

This means up to 10200 of unemployment compensation is not taxable on your 2020 tax return. Meanwhile households who are receiving the cash refund by paper check can. The procedure for requesting the third stimulus check that has not arrived to you.

On Form 1099-G. In Box 4 you will see the amount of federal income tax that was withheld. Also note that Form 1099-G does not show the amount that you.

Four million Americans will receive their unemployment tax refunds this week Credit. Please note that the unemployment provision of the American Rescue Plan Act is an exclusion from income not a tax credit. The following security code is necessary to.

By the way those who had their unemployment benefits restored under new legislation passed January 7 2003 wont pay the Feds any taxes on them this April -- they only. When submitting a check or money order. More money is arriving for unemployment-related tax refunds via direct deposit and paper checks.

New stimulus checks are available in all these states check if youre eligible. Unemployment tax credit check Sunday March 27 2022 Edit. To report unemployment compensation on your 2021 tax return.

If you are still eligible and have. The IRS has already processed most of the 1400 third round payments. Enter the security code displayed below and then select Continue.

You cannot check it.

Unemployment Tax Refund Update What Is Irs Treas 310 Weareiowa Com

Fourth Stimulus Check Live Updates New Payment In California Unemployment Benefits Child Tax Credit As Usa

Child Tax Credit Opt Out When Is The Deadline Wfla

Here S How The 10 200 Unemployment Tax Break Works

Financial Wisdom Coaching Llc American Rescue Plan Act Of 2021 Expands Benefits In Many Areas Including The Expansion Of Child Tax Credit Enhancement To The Child And Dependent Care Credit For

Dor Unemployment Compensation State Taxes

Unemployment 10 200 Tax Credit Irs Begins Refund In May If You Filed

Required Information Skip To Question The Chegg Com

Irs Unemployment Tax Refunds May Be Seized For Unpaid Debt And Taxes

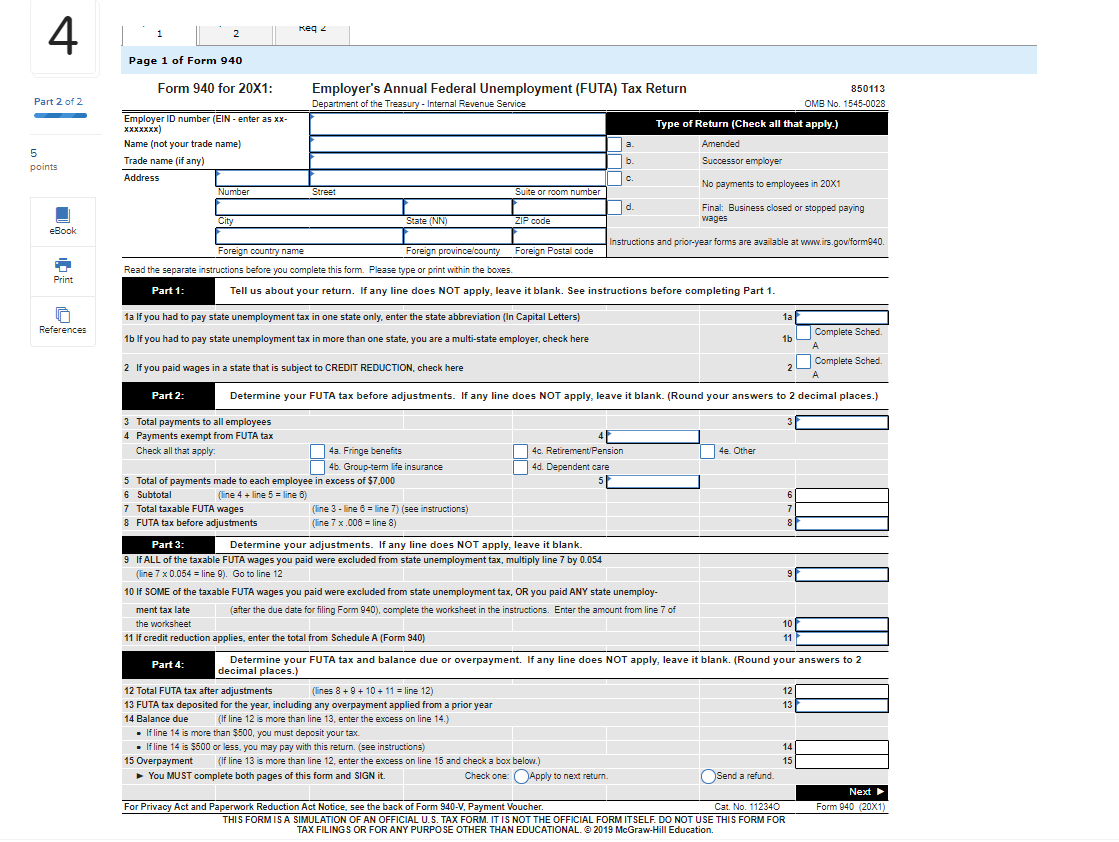

What Is The Futa Tax 2022 Tax Rates And Info Onpay

Tax Refunds Stimulus Payments Child Credits Could Complicate Filings

Do I Have To Pay Taxes On My Unemployment Benefits Get It Back

Guide To Unemployment Taxes H R Block

Unemployment Tax Refunds And Money For Child Tax Credit To Arrive Soon

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

Some 2020 Unemployment Tax Refunds Delayed Until 2022 Irs Says

Renewed Tax Credit Helps Indiana Employers Hire Workers Wtca

The New 3 600 Child Tax Credit Watch For Two Letters From The Irs Wkrc

If You Were On Unemployment Last Year You Ll Probably Get A Tax Break Marketplace